The Need for Empathy in Financial Marketing

Insights from research with advisors and investors on communicating during COVID-19

Marketers across industries are wrestling with how best to communicate during this crisis — the right content, the right tone, the right channels, the right frequency.

This is particularly sensitive in the wealth management space, where time-strapped financial advisors are on the front lines trying to keep clients informed, while not wanting to overwhelm them or appear insensitive to other concerns in their lives.

Over the past week, Sullivan conducted parallel surveys of financial advisors and affluent investors to get a gut check on how they are managing in the early stages of this crisis. Interviews with financial advisors added further insight. Here are our key takeaways:

At least for now, the softer skills are needed most.

“Lots of people can create portfolios. But I think I earn client trust most during volatile, scary markets like these…when I’m more like their financial therapist.” — Advisor

“A positive tone goes a long way in easing our minds.” — Client

“My older clients honestly just want to hear my voice and know that everything is going to be ok. This is why they pay me, to be there for them at times like this.” — Advisor

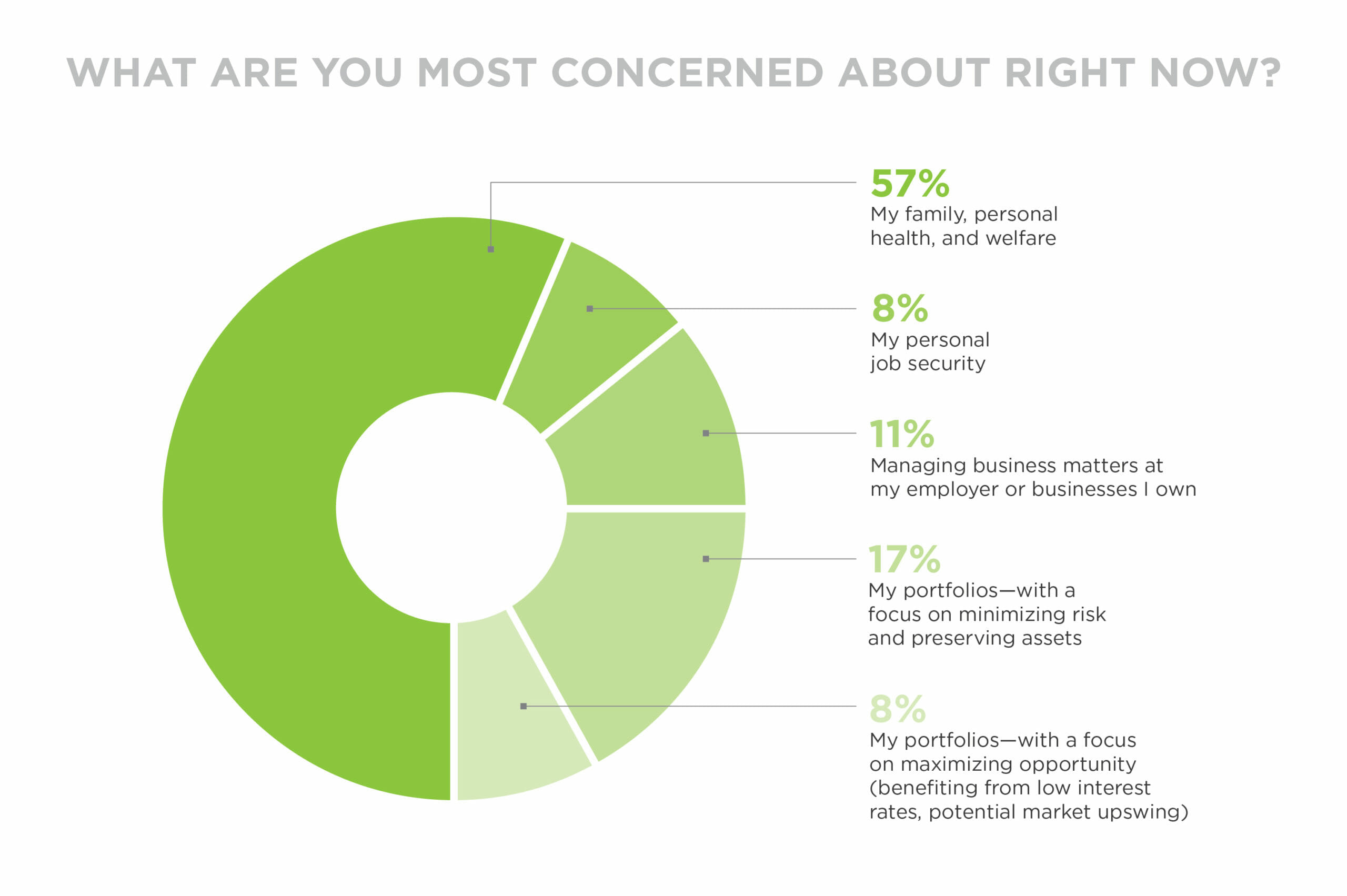

It’s tempting to get caught up in the malaise of the markets, but with our sample of investors, that’s not their main concern… not by a longshot.

In this vein, advisors should be discerning about what market insights to share. Firms and CIOs may provide useful content, but holding back on some of these communications will eliminate noise and make room for more personalized outreach. Conversation guides and training will also help advisors looking for guidance with the “therapist” part of the job.

Proactively include clients’ spouses and families.

“In times like these, I always insist on speaking with the couple, not just the main client. It’s a chance to educate and reassure both of them, as they’re often feeling different things. I often find that the partner asks more questions and ends up more appreciative than my main client.” — Advisor

Most advisors are communicating with their clients during this crisis, but spouses and children often have as many questions during turbulent times, even if they’re not the ones calling. Many advisors have felt uncomfortable forging bonds with their clients’ significant others. But with couples spending more time together at home, they may welcome the opportunity to have an open conversation about financial concerns.

Many firms have developed programs for connecting with spouses and “next gen,” and now is a good time to activate them.

Not another COVID-19 email!

With every company under the sun sending communications around COVID-19, financial marketers need to be sure that their content is standing out — especially since updates on the markets and personal financial wellbeing will be ones people want to read.

While only 7% of advisors said they did not send any market-related communications since the start of the crisis, a surprising number of clients — 33% — said they hadn’t received anything. The difference is likely driven by impersonal batch emails that clients don’t notice or mistake as spam, particularly given the monotony in inboxes.

“Group emails often get lost. Clients think they’re spam or a generic update. In times like this, people are inundated with emails from everyone. It’s our job to make important messages get through the clutter. So I’ve never, and will never, send a mass email to clients.” — Advisor

That’s not to say that firms’ insights and newsletters aren’t of value — 56% of investors who did receive them found them helpful. To ensure that more people are consuming this valuable content, marketers should take a “test and learn” approach.

Experiment with different subject lines, develop more personalized content (especially in email previews and subject lines where they’ll be noticed faster), resend unopened communications, and encourage advisors and those on the front lines to flag newsletters and content to reference them during calls.

Everybody’s doing it.

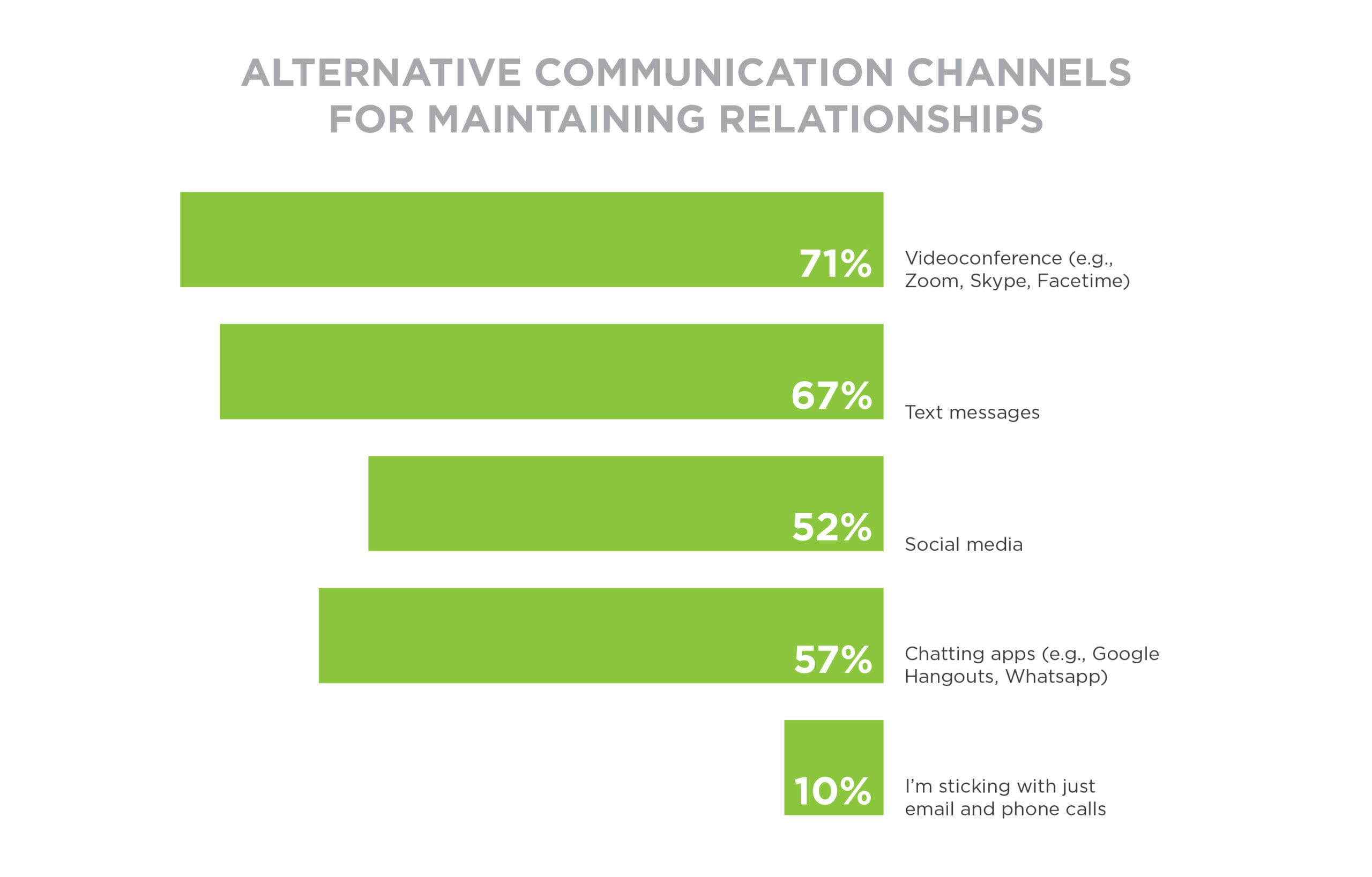

Personal connections mean the most, and they’re now being forged through video calls, text messaging, and even social media. Video conferencing is one of the most prominent changes we’re seeing, which makes sense since it’s useful for conveying empathy and feeling closer.

But adopting new technology and completely changing workflow is daunting. Firms should provide training for advisors and employees alike, recommend best practices for virtual meetings, and check in with clients to be sure they’re comfortable, too. Not only will this reduce barriers to using new tools, but it will help remove unnecessary anxiety from already-difficult conversations.

The bright side is that these forms of technology may be embraced more widely once the crisis has subsided, enabling changes in efficiency and more modern workplaces. Some clients and advisors we spoke to are finding the new channels so seamless that they have no plans to stop using them.

“I have a $10 million dollar client that lives less than a mile from me. We had a videoconference instead of meeting in person, and his kids joined with their questions. He said he wants to have all our meetings like this going forward!” — Advisor

As empathy takes the center stage, we’re reminded that despite financial implications, this is first and foremost a humanitarian crisis. Marketers should keep that top of mind while assessing their approach to this evolving moment.

This article is part of our ongoing content around marketing during COVID-19. For more ideas, research, and support, visit our Resource Center.