Financial Marketers: Keep Going, it’s (Mostly) Working!

How wealth management clients are feeling one month into shelter in place

We’ve been monitoring how affluent investors are faring during this pandemic, with a focus on their experience with the financial advisors who serve them. We completed our second survey* last week, and found some key areas of opportunity for financial marketers.

1) Avoid going dark to protect the long-term health of your brand.

Overall, firms and advisors are getting high marks for how they have been servicing clients over the past two months. Still, a surprising number of clients reported that they had no contact at all from those handling their assets during this unprecedented health and financial crisis.

This reminded us of the research Sullivan conducted after the events of 2008-2009. Then too, some advisors and firms sought to avoid difficult conversations, and later faced an uphill battle to regain trust.

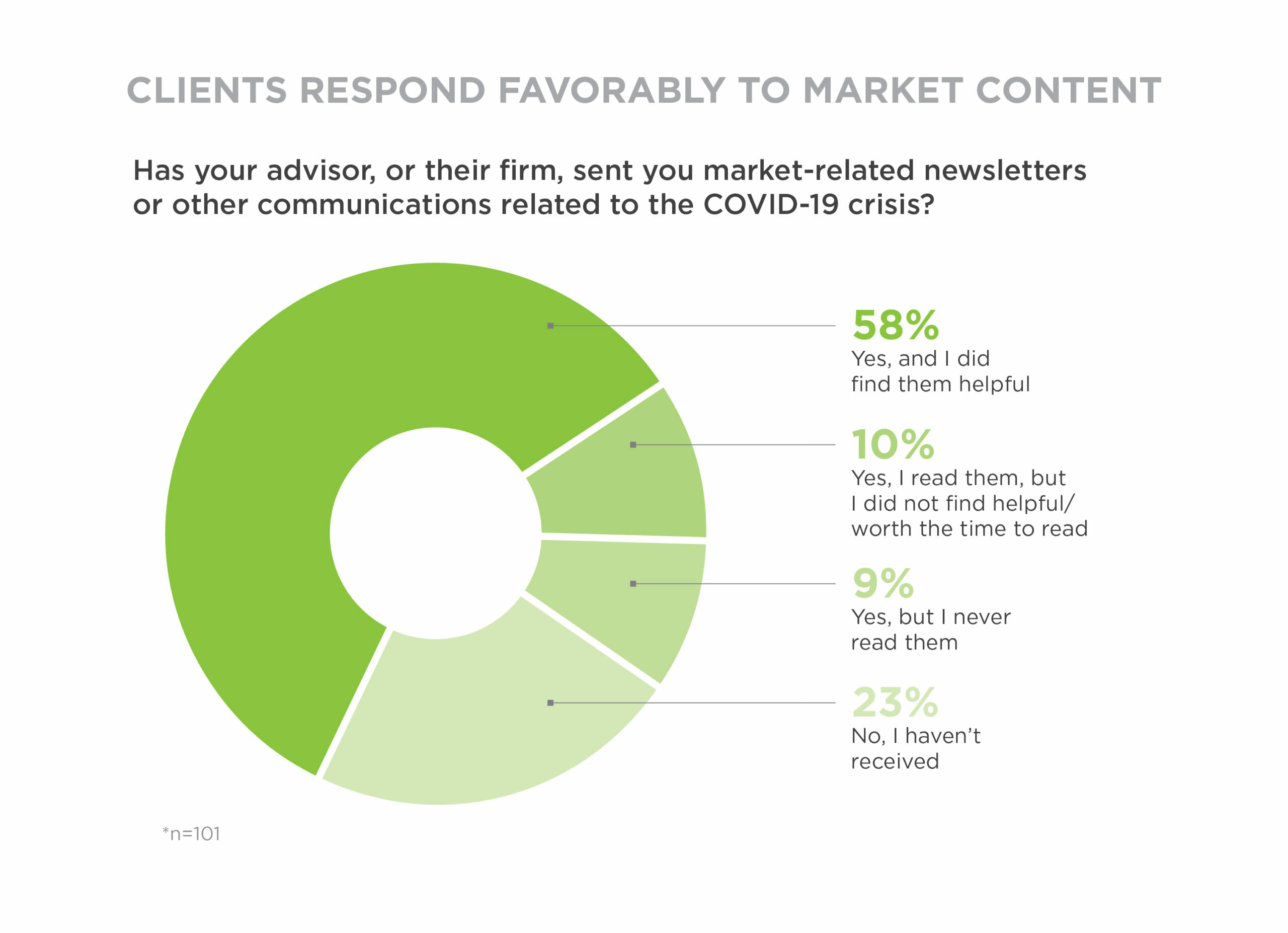

In our latest survey, nearly a quarter of clients (23%) say they haven’t received any communications at all from their advisor or advisor’s firm since the crisis began. This was an even bigger issue in last month’s survey, when a third of clients said they hadn’t been contacted.

How could this be, given how much time and energy financial marketers are putting into rapid-response communications these days?

It’s likely that communications aren’t breaking through the enormous COVID clutter, or advisors may not be passing along communications because they’re worried about overwhelming their clients, or perhaps they are overwhelmed themselves. A quick survey of your advisors may help you zero in on any logjams and how to fix your financial services branding and communication issues.

When these communications do reach clients, they are having a positive impact. The majority of consumers receiving market-related content are finding it helpful, with a significant upward jump from last month (from 38% to 58%). And in terms of frequency, only a tiny percentage of clients (2%) wish their advisor was communicating less often.

For financial marketers struggling with tough choices on how to allocate budget dollars, it’s also worth noting that investors listed the financial news media and advisory firm websites rated among the most helpful sources of financial advice and guidance (aside from their advisors).

With these customers likely spending more time online at home, enhancing your site experience and increasing spend in targeted paid media could yield outsized returns and a greater share of voice.

2) Sales and client teams are getting rave reviews. Make sure there is a loop for them to hear feedback, and a virtual vehicle to share success stories.

The debate over whether professional financial advice is worth the fees has been going on for decades. For those already engaged with advisors during these trying times, there is little doubt that they think they are getting their money’s worth, at least right now.

In our current survey, 91% of clients said the advice they are getting is worth the fee they are paying their advisor. Similarly, satisfaction is also high, with 92% of clients “very satisfied” or “somewhat satisfied.”

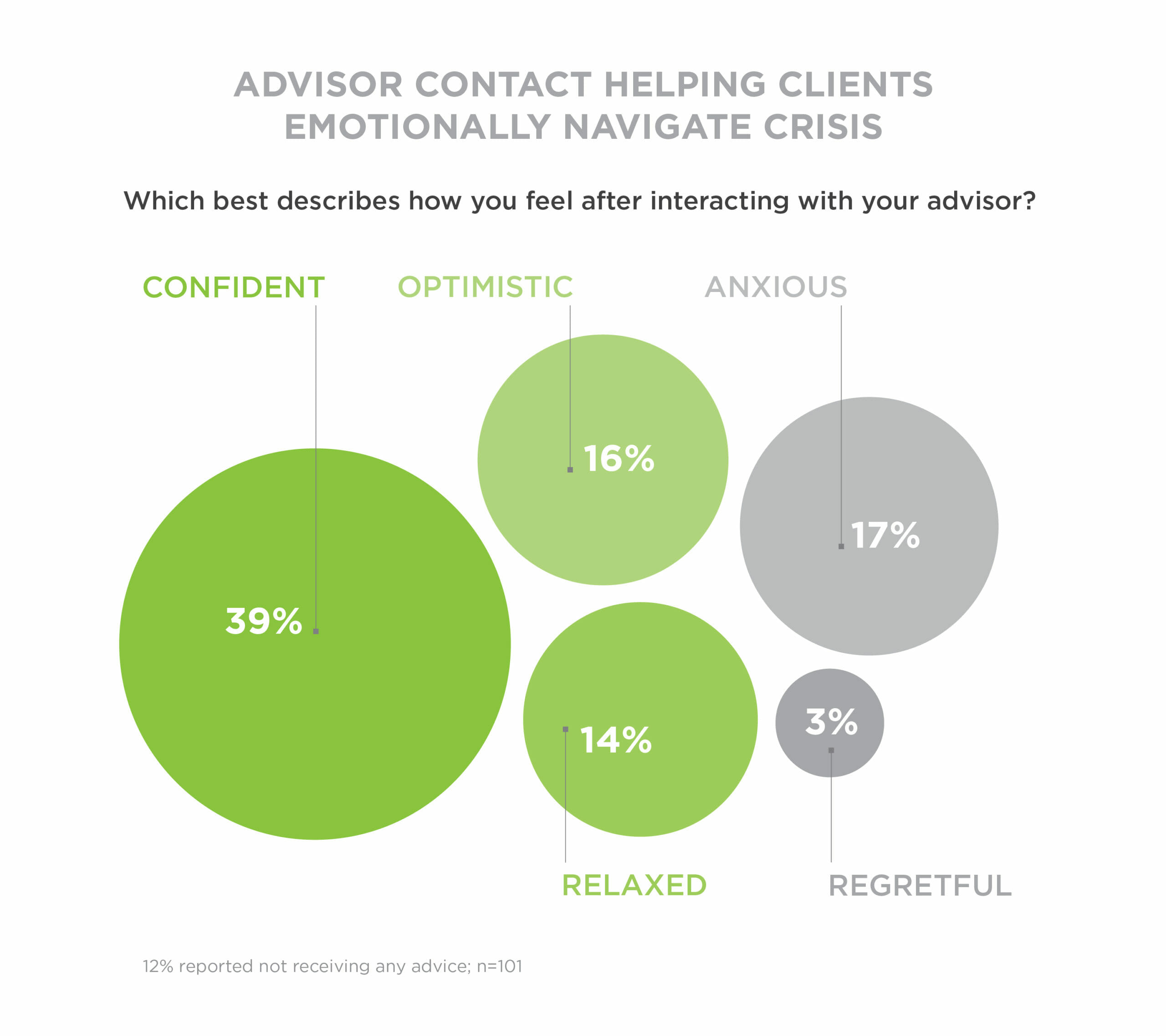

Despite the brutal market environment, advisor conversations with their clients are having a soothing impact. When asked how personal interactions with their advisors have made them feel, more than 68% cited positive feelings, with “confident” rising to the top of the list.

It’s also worth reinforcing that clients are highly appreciative of advisors reaching out to tell them to do absolutely nothing. When asked what is the most valuable piece of advice they’d received from their advisor during this crisis, 74% said simply “stick to my diversified plan.”

Advisors and their support staff may feel beleaguered and need extra support and reinforcement during this stressful period. With most working from home for the foreseeable future, think about beefing up your intranet, ensuring that content and tools for advisors are current and easy to find.

The best intranets can also serve as communities to share ideas, boost morale and strengthen your employer brand. We recently partnered with a global alternative investments manager on the strategy and development of their new intranet, and were thrilled when they told us it played a huge role in “helping to bring the firm together” during the pandemic, with an 86% adoption rate in its first month after launch.

3) Think beyond the primary client.

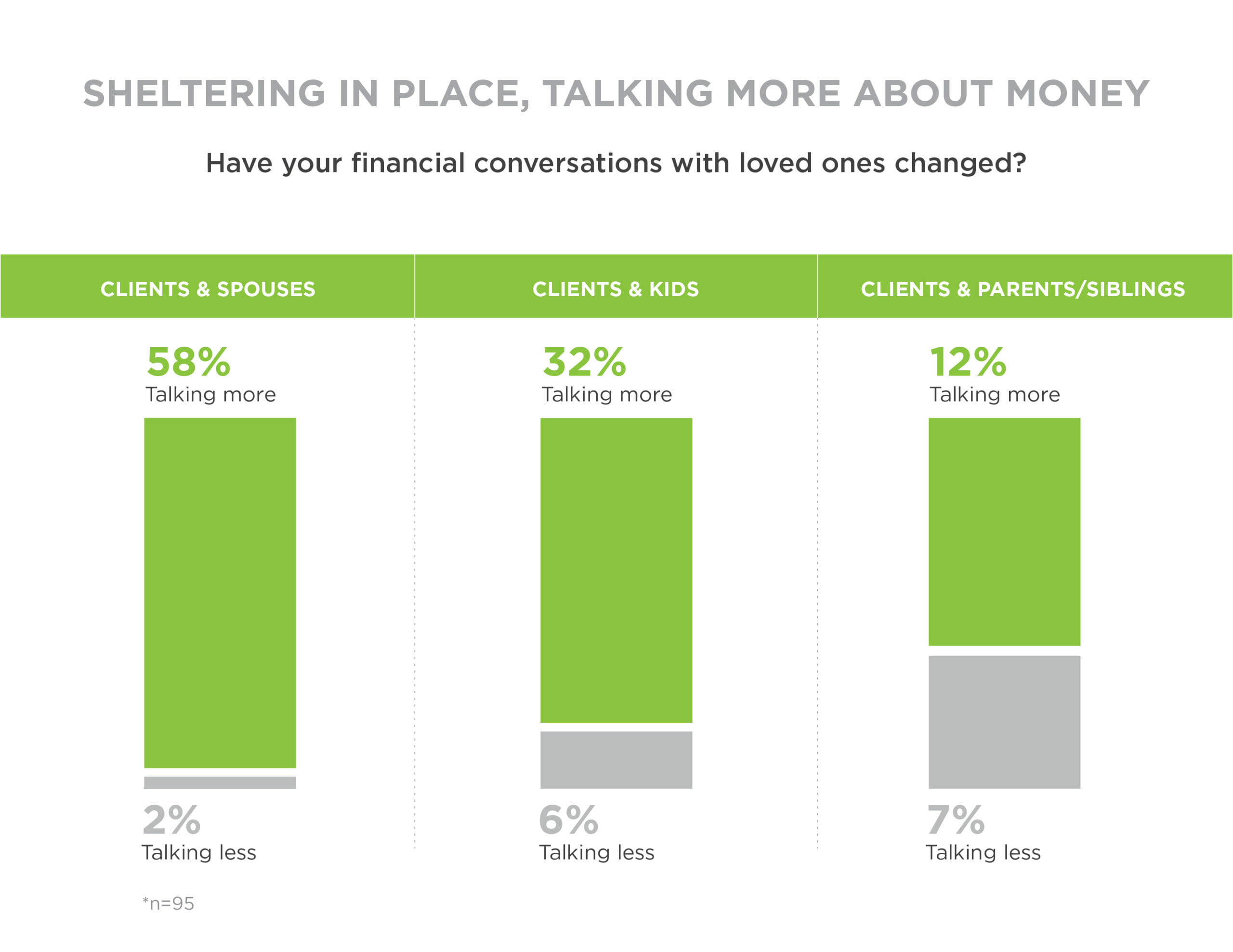

Many firms and advisors have long struggled to forge bonds with spouses and “next gen” potential clients. One silver lining of this crisis may be that sheltering-in-place families seem to be talking more openly and frequently about important financial matters.

In our latest survey, 59% said they are talking more with their spouse or partner, 33% talking more with children, and 13% talking more with parents and/or siblings.

Surprisingly, fewer than 10% of clients had discussed or had even thought about topics like deferring mortgage payments, tax-loss harvesting, planning for a potential job loss, or how government stimulus programs may or may not impact their families.

For many firms, now is an ideal time to communicate on a broader range of topics, and to encourage advisors to offer up conversations with clients’ families (as a value-add, not a hard sell).

We’ll continue to share our research and thoughts on how marketers can navigate the pandemic. Watch for our next post featuring our survey of self-directed investors, and find more related content on our Marketing Resource Center.

*Online survey of investors with $250k+ in investable assets, all currently working with a professional financial advisor. Fielded April 9, 2020, n=101.