Brand Decisions Matter in Fintech M&A

4 keys to branding success for marketers managing an M&A

FinTech is booming. Fundraising from Q2 of 2021 was the industry’s largest on record with a total of 657 deals where global VC-backed companies raised a record 30.8 billion (CB Insights). As companies strategize growth and prioritize scale, they face a decision—eat or be eaten. And with an increasing flow of capital to fuel momentum, there’s been a massive hunger for mergers and acquisitions.

(Sources: JP Morgan; CB Insights; CB Insights; Business Wire; Wall Street Journal)

Whether it’s a small acquisition, a merger of equals, or a massive transaction–every integration adds value. Navigating financial services branding and communications decisions during this time can be challenging, but with the right strategies in place marketers can ensure efficiency, boost brand equity, and get ahead of the competition.

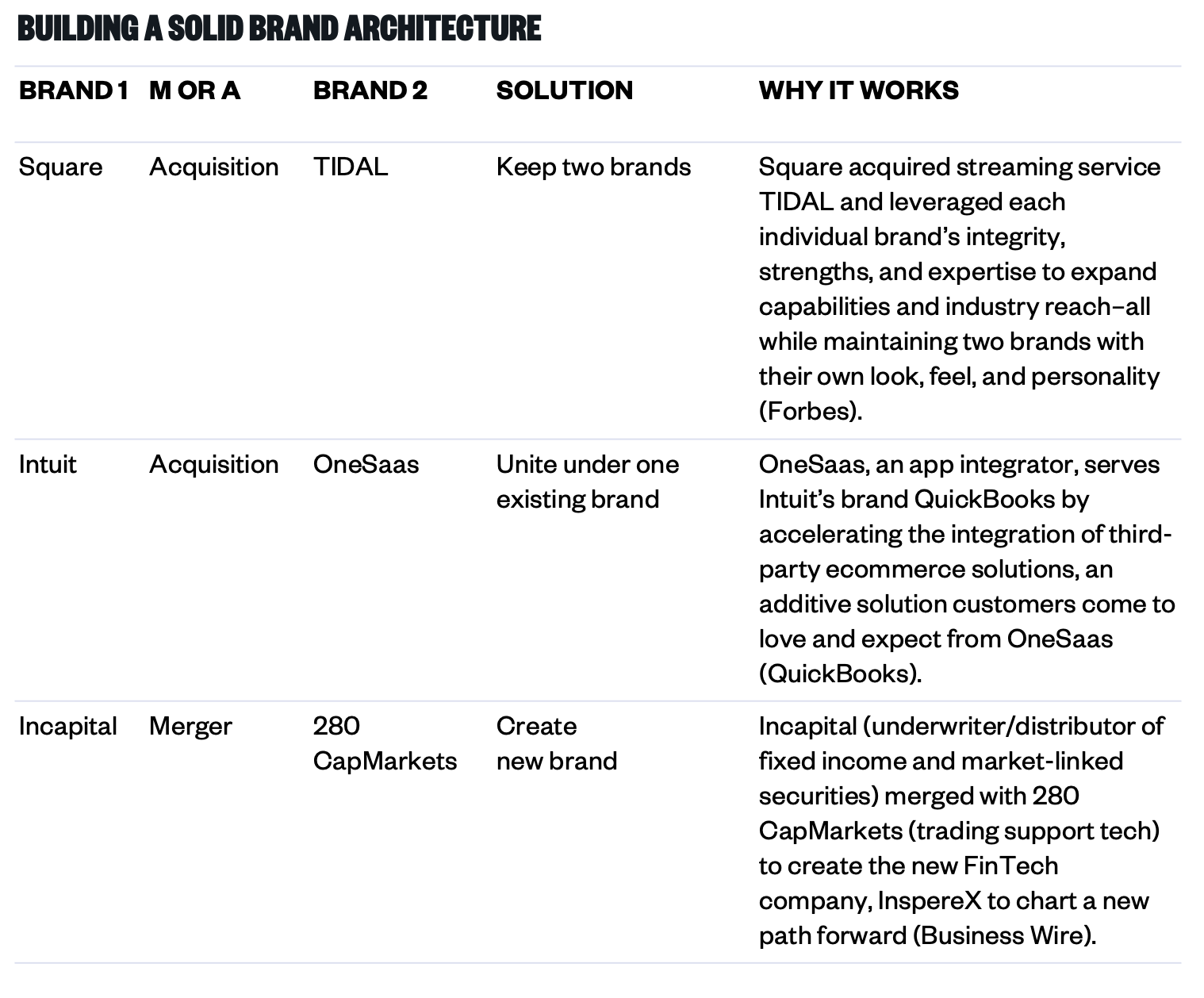

1. Build a go-to-market structure with the customer in mind

The strongest brand architectures are built from the outside in. From the top-down, look at your brands from the customer or client’s point of view and determine how to best meet their expectations and preferences. As we’ve seen in the industry, there’s no one-way to do it, but a number of approaches post-M&A. If multiple brands offer overlapping products/services or one brand is clearly dominant, it could be folding one in and keeping the other, unifying under one brand. If each brand offers unique value and strong equity you may keep both alive. Or if acquiring multiple brands or making a large change to offerings, you could consider launching something entirely new. Building a solid brand architecture makes all the difference. For example, check out our work with tech infrastructure company Crown Castle who we’ve helped numerous times to consolidate acquisitions under their master brand.

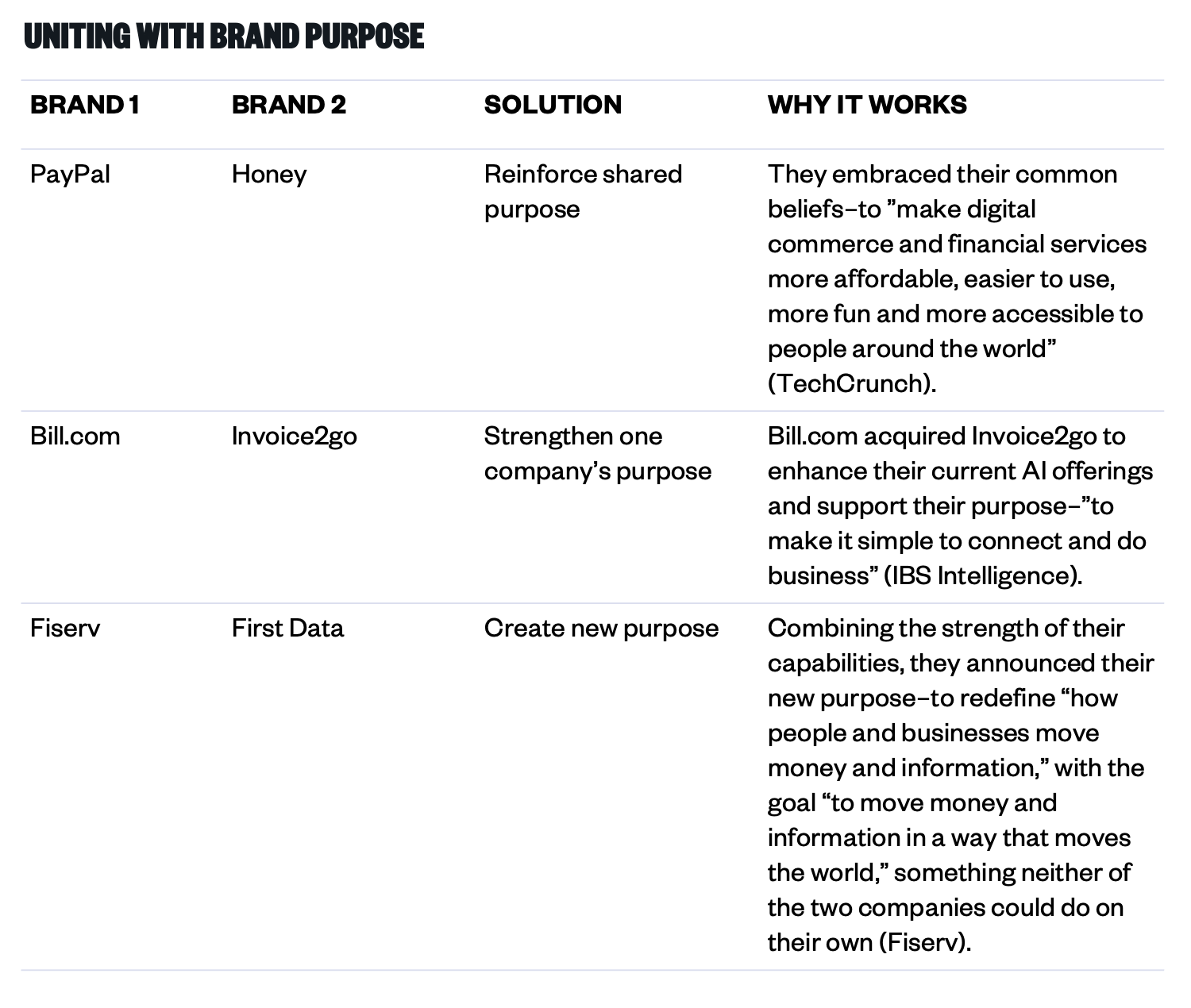

2. Establish your brand purpose

We’ve said it before, and we’ll say it again: a powerful purpose is the ultimate business strategy. Mergers and acquisitions are perfect opportunities to either reinforce an existing shared positioning, strengthen one company’s mission, or adjust the brand purpose entirely based on the new company goals. How you use this purpose will play out differently for each business. For example, take a look at the website we created for Yale School of Music where we used their brand purpose to unify three websites into one brand experience.

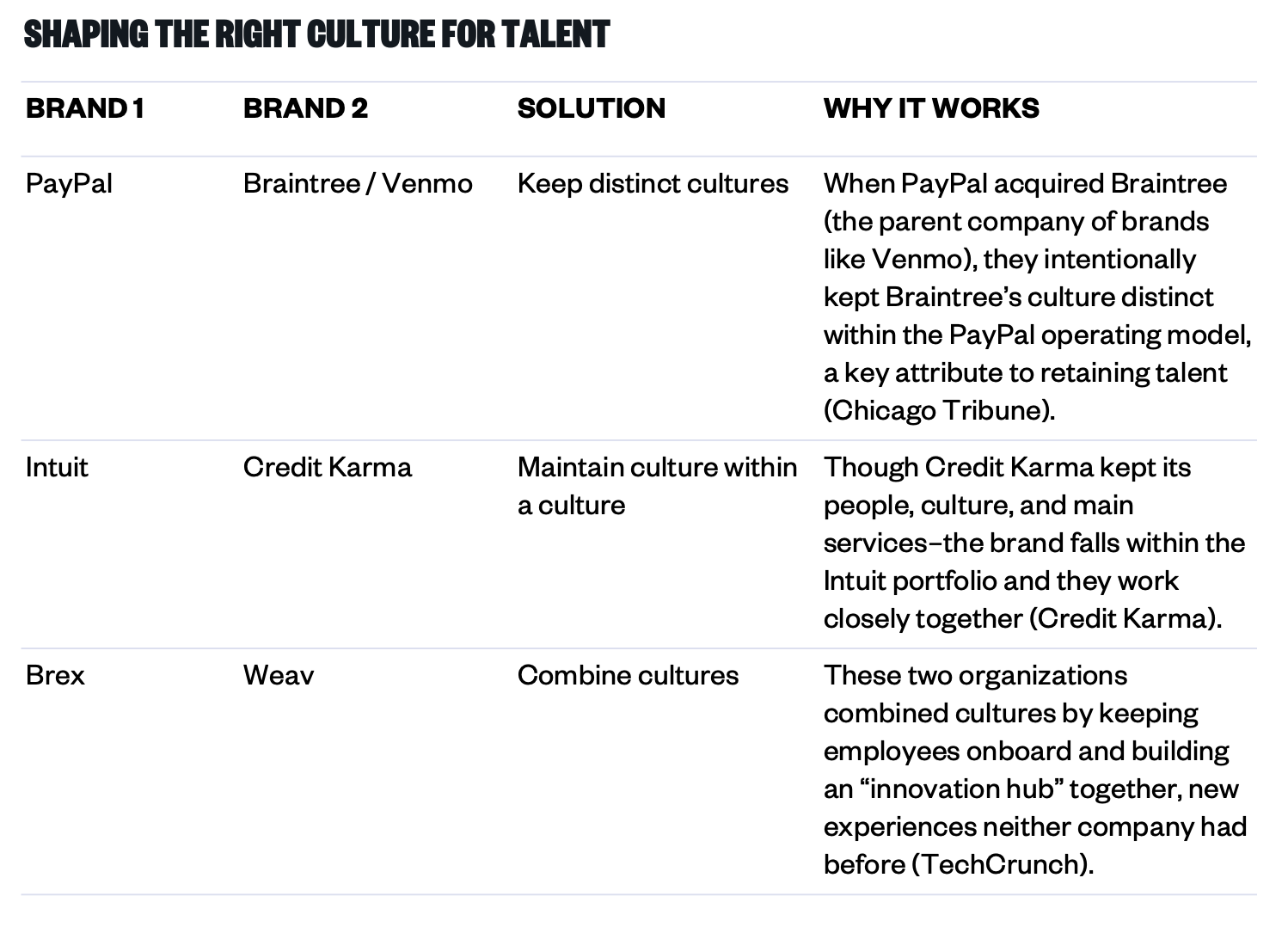

3. Rally culture from the inside out

In a merger or acquisition, employees are typically a big part of the purchase. And, especially in this industry, culture matters. The battle for talent in this attractive and growing field of FinTech is hyper-competitive, so it’s crucial to maintain a solid culture throughout the change. Be vocal and transparent with employees every step of the way. Set clear expectations and forge an evolved culture together. If a brand name or logo is eliminated, that doesn’t mean elements of the culture have to die with it. It can be beneficial to bring traditions, celebrations, and behaviors from that company over into the new culture. In the end, there’s an opportunity to combine the best attributes from each company to make all team members feel excited about the future possibilities. There are many ways to bring this to life. For example, check out our work for Insight Partners where we created a hymn book to rally their employees around their new brand, purpose, mission, and beyond.

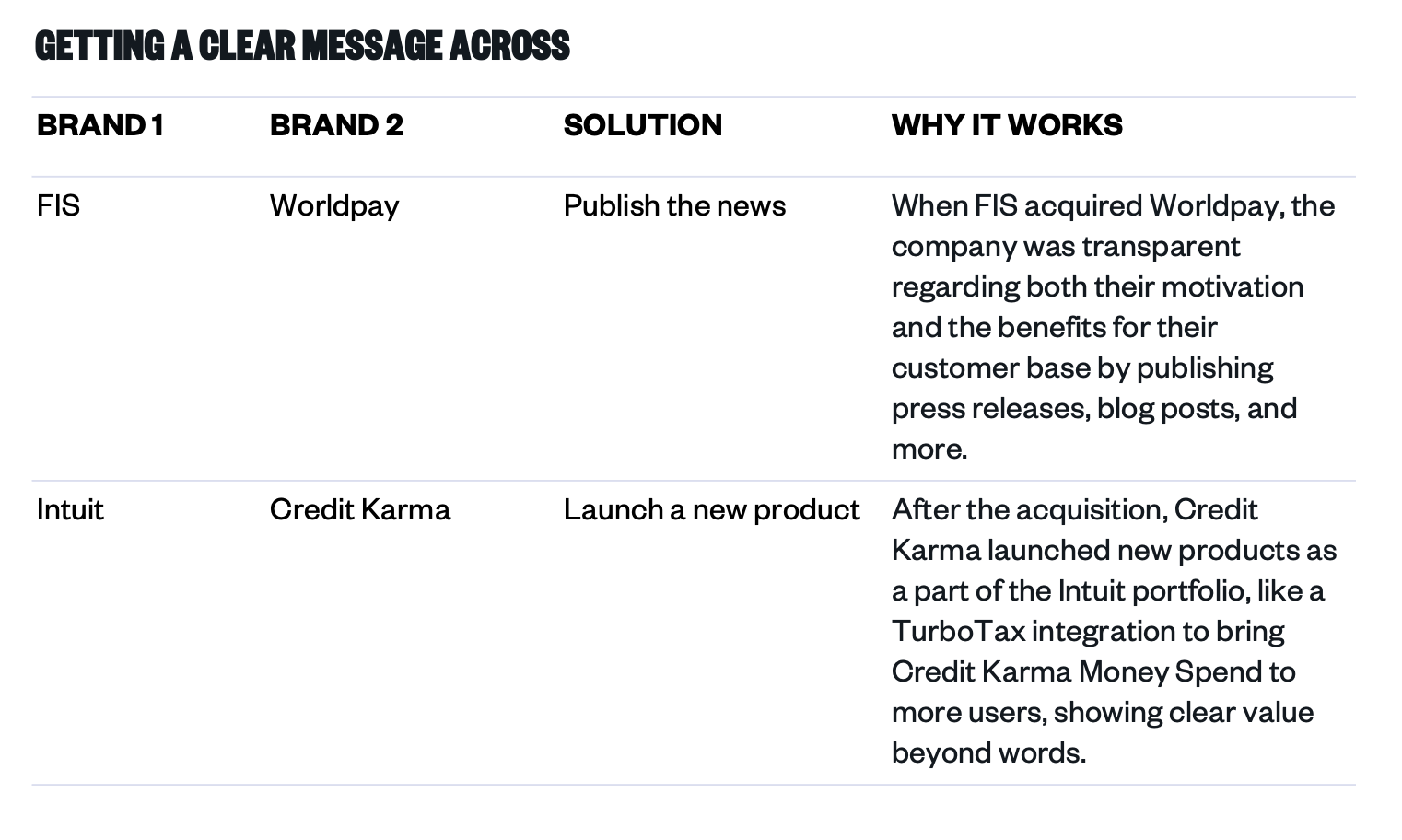

4. Communicate changes early and often

Words bring clarity; experiences build credibility. After any company change, it’s imperative to update employees, customers, and the industry properly to maintain and build trust. Be clear about the reason for the merger or acquisition and what value people should expect. Update the brand experience from every touchpoint (programs, services, interactions, voice, design).

Then, strategize the best way to get the word out to everyone else. For a deeper dive into financial marketing as consumer trust evolves, check out our recent blog post: Reopening, Robos, and Purpose.

Where to next?

In FinTech, we can expect rapid growth and constant change. To prepare, marketers should anticipate this change, work nimbly, and embrace the opportunities that come with each integration. Your brand and communications, inside and out, are key assets to make sure the value of any deal measures up to (and surpasses) expectations.